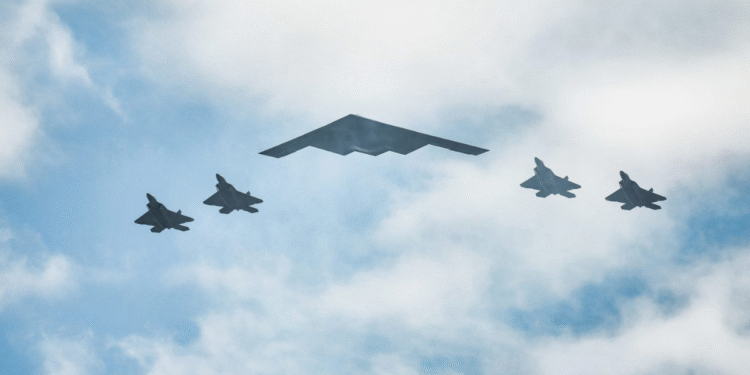

The financial markets were shaken early Friday as Dow Jones futures dropped by more than 150 points after reports emerged that the United States had carried out airstrikes on Iran’s nuclear facilities. This military action marks a major escalation in the already tense situation in the Middle East, sparking concerns over broader regional conflict and pushing global oil prices sharply higher.

The U.S. reportedly targeted multiple nuclear sites inside Iran in a surprise military operation that took place late Thursday night. While full details are still emerging, the strike is said to have been in response to alleged threats from Iran and its continued uranium enrichment efforts despite international warnings.

Dow Futures Drop Over 150 Points

This Article Includes

Following the news, Dow Jones Industrial Average futures fell by around 150 points in premarket trading. Investors are showing increased nervousness about the potential for a wider military conflict in the Middle East, which could severely impact the global economy.

S&P 500 and Nasdaq futures also showed losses, though not as steep. The fear is that prolonged tensions or war in the region could lead to energy supply disruptions, affecting inflation and interest rate projections in the coming months.

Oil Prices Jump as Supply Fears Grow

Oil prices immediately spiked after the attack. Brent crude surged by more than 3%, crossing $88 per barrel, while West Texas Intermediate (WTI) crude jumped above $85. Markets are reacting to the possibility of major supply disruptions from the Persian Gulf — a region that accounts for a significant portion of the world’s oil output.

If Iran retaliates or if global shipping through the Strait of Hormuz — a key oil transit chokepoint — is affected, oil prices could rise even further. This would put extra pressure on consumers worldwide already dealing with high fuel and energy costs.

Investor Sentiment Turns Cautious

Market analysts believe the attack and the rising geopolitical risks could reverse recent positive momentum in U.S. and global markets. Stocks had shown strong gains earlier this week after positive economic data and hopes of interest rate cuts later in the year. But now, fears of war and inflation may overshadow those gains.

Safe-haven assets like gold saw renewed interest. Gold prices jumped more than 1% to trade above $2,370 per ounce, as investors moved funds into safer options.

Global Leaders Call for Calm

In response to the escalating situation, several world leaders have urged restraint. The United Nations called for de-escalation and warned that a full-scale war could have “catastrophic consequences” for the region and the world.

European Union officials and leaders from China and Russia also expressed concern, warning that rising tensions could destabilize global supply chains and financial markets. As of now, Iran has yet to publicly confirm the extent of damage from the airstrikes or how it plans to respond.

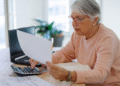

What This Means for the Common Investor

For everyday investors, the message is simple: volatility may return in a big way. Markets could continue to swing sharply based on headlines coming out of the Middle East. Sectors like defense, energy, and commodities could see major movement.

Investors are advised to stay cautious, avoid panic selling, and focus on long-term strategies. Diversification and investing in assets that can perform well in uncertain times — like gold, defense stocks, and energy — might be wise.

Conclusion

The U.S. airstrikes on Iran’s nuclear sites have triggered a ripple effect across global financial markets. While the full geopolitical outcome remains uncertain, early signs point to increased market volatility, rising oil prices, and nervous investor sentiment. The coming days will be crucial as the world watches how Iran responds and whether diplomacy can prevent further escalation.